- ASRY Awarded 2024 RoSPA Gold Medal in Health and Safety

- BP ponders shifting focus away from renewables, say sources

- QatarEnergy enters 10-year naphtha supply agreement with Japan’s ENEOS Corporation

- The International Energy Agency expects oil demand growth to slow in 2024

- The International Monetary Fund re-selects Kristalina Georgieva as its director

- Libya to target producing 1.4 million b/d by end 2024

- TotalEnergies launches the Marsa LNG project and deploys it multi-energy strategy in Oman

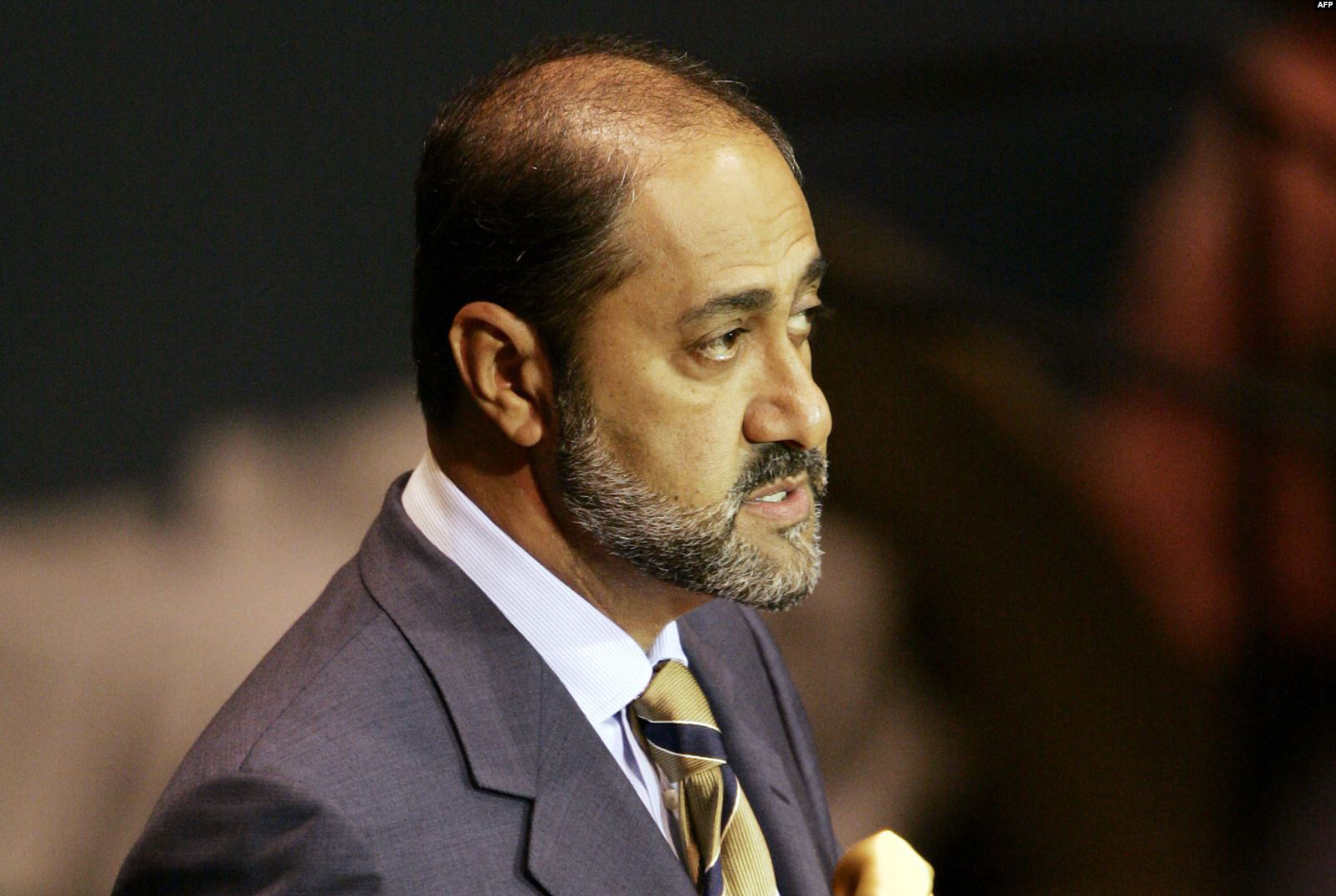

- H.E. Minister Al-Kaabi: Demand for oil and gas will continue for long; we have to be responsible, and Qatar is doing its part

- Egypt to stop exporting LNG starting from the beginning of May 2024

- QatarEnergy selects Nakilat to own and operate 25 conventional LNG vessels

Oman to establish “Oman Energy Development Company”, to explore and produce oil and gas and to manage renewable energy projects.

Reuters and Omani media have reported that a new Omani national energy company will have a part of the largest oil area in the country and will have the ability to borrow, in a move that would help the Sultanate of Oman to adapt to the repercussions of low oil prices.

The Official Gazette published a decree establishing a “closed Omani joint stock company in the name of Energy Development Oman signed by Sultan Haitham bin Tariq bin Taymour on December 3, 2020.

The Official Gazette reported that the New Oman Energy Development Company will own a “shareholding” in the Petroleum Development Oman, a government company for oil and gas exploration and production, as well as a stake in oil agreements related to the block 6, which includes the largest oil and gas operations in Oman. The new company will work in oil and gas exploration as well as renewable energy projects in Oman.

Oman, which has the highest risk rating of all major credit rating agencies, faces growing deficits and large debt maturities in the next few years. Most recently, it embarked on a new financial plan to reduce its dependence on crude oil revenues.

Low oil prices and an economic slowdown due to the coronavirus outbreak are adversely affected the Omani public finance.

It is worth noting that Sultan Haitham bin Tariq, the new ruler of the Sultanate of Oman after Sultan Qaboos bin Said, may God have mercy on him, has made tangible changes in the government and state agencies. In October 2020, he approved the application of a value-added tax to support state revenues.